Apple’s Q2 earning threw a curved ball at the market. Yes, the iPhone sales boomed, thanks to the deal with China Mobile.

The revenues at $45.6B never looked better! The

report exposed the wrinkle in the declining iPad sales, the product that has grown

to 200M in the shortest time in the company’s history. That decline sent a jitter in the market. While

attempts were made to explain this decline away as temporary phenomena (not a Christmas Quarter or

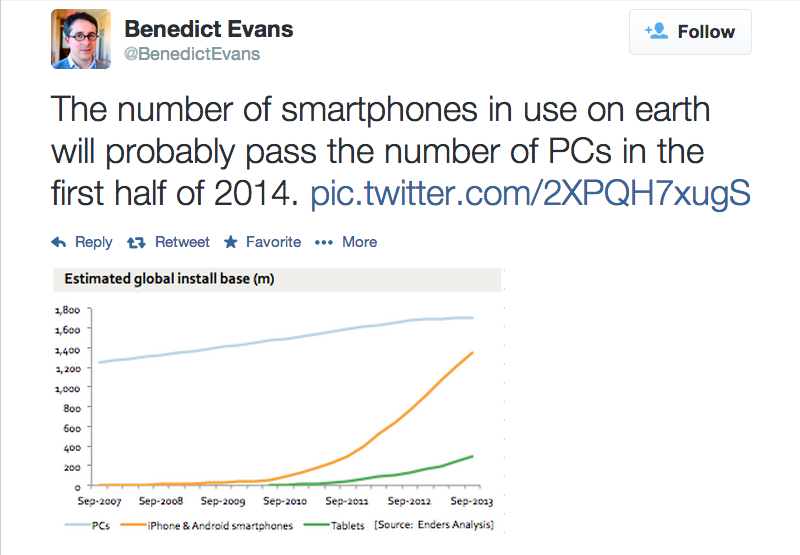

an inventory goof up…), but as this excellent analysis from Benedict

Evans shows, iPad has a use perception problem.

Yes you do not replace a tablet as frequently as

you do your smartphone (more often facilitated by your mobile carrier). The core issue is the belief that tablets are replacement for bulky laptops/PCs. This has not happened as anticipated.

To be fair the PCs/laptops shipment has been declining steadily, and to be equally fair this handy device is

not a direct replacement and for a good reasons. You can accomplish a lot with a tablet besides watching Netflix or

YouTube videos, but your iPad is not exactly as hardworking a workhorse for your work or profession. It remain

to be seen if availability of Microsoft Office on iPads will push this device

a bit more into the realm of replacement for future laptops.

On a side note, Benedict Evan also concluded that we (the makers, users and

investors) should think of comparing “smartphones” with “tablets and laptops”

and stop clubbing tablets and smartphones together. He argues that smartphones,

with their vast numbers and ubiquitous presence, is “transformative.” Following his reasoning one

cannot escape the conclusion that it will take some more time before “tablets” will emerge as a

game changer in the laptop/desktop use segment.

Awsome yet with the same issue!

Google Glass is a very different device. However, it is

facing a similar perception problem while attempting to move its users beyond

being labeled as “Glassholes.” You could

be active and light in exploring your world…. but where do you go from there with a device that costs more than most laptops?

Clearly both devices are not general purpose computing

gadgets. Both would be excellent devices for special purpose

or specialized use!

Tim Cook alluded to this when he pointed out that 95 percent share of America's education tablet market, is held by tablet (emphasis is mine). I know of one startup that

is using tablets extensively for teaching kids that need special education.

Tablets are

being used as check out devices in retail stores, and for browsing menus in restaurants; doctors are using iPads for remote diagnosis. There is a

potentially huge but little explored territory where we need information and some interaction,

but not require a whole lot of computing. Tablets fit right in.

Google Glass is probably moving in that

direction. It’s use in helping firefighters, doctors and surgeons is being explored. NYPD is

testing Glass's efficacy for the New York’s finest. Air Force is checking

if it can be a useful visual accessory for its air traffic controllers.

An

intrepid legal firm is testing

if Glass can provide relevant information faster, to help its personal injury clients. A

breastfeeding support website in Australia is advocating

the use of Glass to help new mothers in breastfeeding.

Both the devices have pushed the bounds of technology and have put a lot of access literally in our palms.

User will put these to innovative uses, in time, pushing the envelopes in human-machine interaction and accessing knowledge. It is in the hands of users, not investors.

Tech companies will in the meanwhile, continue to play the cat-and-mouse with Wall Street!